Monetizing Nasdaq-100® Tail Hedges

Testing the Effectiveness of Implied Volatility Signals

Study Summary

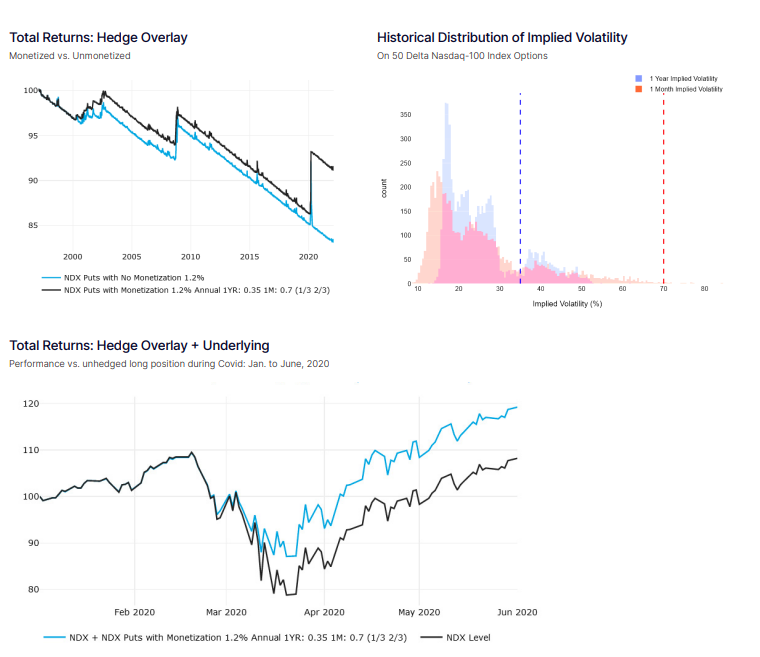

We explore the effects of an implied volatility based monetization scheme on a laddered put strategy on the Nasdaq-100 Index (NDX). The strategy holds 1, 2, and 3 month put options on NDX struck 20% out of the money. We purchase new 3 month puts at each third Friday expiry, spending 10bps per month (1.2% annually) of a total portfolio notional. We also analyze performance with a joint long position in NDX to demonstrate the value of systematic monetization of options contracts to lock in gains from adverse market events. Specifically, when a monetization event occurs, proceeds from the sale of puts are stored in an interest bearing cash account until the next roll day when proceeds are invested firstly into a new 3 month put and the remainder into NDX. Implied volatility is referenced as the 50 delta 1 year implied volatility and the 50 delta 1 month implied volatility. The study period ranges from January 1st, 1997 to February 15th, 2022.

In this study, we monetize one third of the options position if the 1 year implied volatility surpasses a 35% threshold and sell the remaining two thirds of the position if 1 month implied volatility surges past a 70% threshold.

Results

We found that there was a significant benefit to including an implied volatility based monetization scheme in reducing impact from market drawdowns. In our study, monetization served as an effective mechanism to capture gains from adverse market events. We found that the monetized strategy reduced annual volatility by 115bps while returns were reduced by only 2bps. By contrast, the unmonetized strategy was effective in reducing risk, but with significant cost as annual returns were lowered by 52bps.

As a standalone overlay (i.e. not including the underlying asset), the monetized strategy outperformed the unmonetized version on a cumulative basis. The unmonetized strategy realized cumulative returns of 16.78% while the monetized strategy realized cumulative returns of 8.77%. The maximum 1 month return of the monetized strategy was 6.26% vs. only 1.89% in the unmonetized strategy.

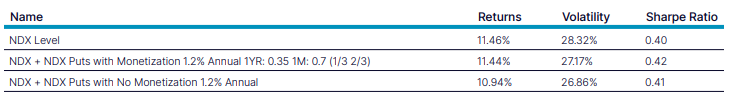

Summary Performance Metrics

Full study period from 1997 to 2022

Historical and simulated index performance is not necessarily indicative of future results. The information provided in this document does not constitute investment advice. Volos is not an investment advisor. Volos and its affiliates accept no responsibility whatsoever for any loss or damage of any kind arising out of the use of any part of the company products or the information contained therein.

© Copyright 2022. All rights reserved. Nasdaq is a registered trademark of Nasdaq, Inc. 1473-Q22