The Benefits of Non‑Correlated Alpha

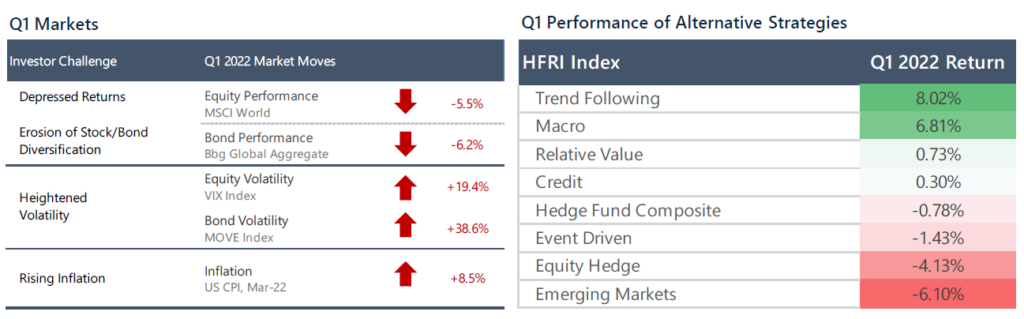

In Q1 2022, 60/40 portfolios suffered as both stocks and bonds sold off and the power of bonds as a diversifier (and, accordingly, a means of reducing portfolio volatility) deteriorated. Meanwhile, record inflation serves to exacerbate the issue and erode real returns. These challenges indicate an increased need for alternatives that offer both diversification to equities and bonds as well as compelling long-term returns.

IN 2022, MANY INVESTORS FACE SEVERAL KEY CHALLENGES

1) Diminishing Returns of a 60/40 Portfolio

In Q1, both equities and bonds posted negative returns. While the trajectory for equities is marked with uncertainty, bond return potential has diminished as historically low yields translate to lower coupon payments, negative real yields, and less scope for price appreciation.

2) Positive Stock/Bond Correlation

Equity/bond relationships are not static, and there have been extended periods of positive stock/bond correlation. Today, historically low yields mean that the protective character of bonds is in jeopardy and investors may see positive correlations between stocks and bonds.

3) Volatility and Market Uncertainty

Given geopolitical developments and macro imbalances, markets have exhibited heightened volatility in recent months alongside an increased potential for market shocks. Should the equity hedging benefits of bonds diminish, the ability to manage portfolio volatility will become more challenging.

4) Inflation Sensitivity

CPI reached a 40-year high of 8.5% in March. Elevated inflation presents a significant risk to stock/bond portfolios in terms of asset valuation, erosion of real returns, and positive correlation. When inflation rises, real yields decline alongside the market price of bonds.

Inflation can also weigh on stocks when combined with hawkish monetary policy, as we saw in the 1970s, potentially leading to simultaneous losses in stocks and bonds and positive correlations.

THE ROLE OF ALTERNATIVES

1) ENHANCE RETURNS

Ideally, investors should seek alternative strategies with positive long-term return and low correlation characteristics, which offer the potential to enhance the risk-adjusted returns of a broader investment portfolio.

2) PROVIDE DIVERSIFICATION

Many alternatives have low correlation to stocks and bonds, with the ability to profit in both rising and falling markets with no inherent bias and the potential to provide equity crisis returns.

3) REDUCE VOLATILITY

Diversification properties result in the potential to reduce the overall volatility and drawdowns of a broader investment portfolio. Active risk management approaches can help navigate market volatility and changing market dynamics.

4) INFLATION AGNOSTIC

Many alternatives can perform well in inflationary or noninflationary regimes and can capitalize on increasing commodity prices during inflationary periods.

WHERE CAN INVESTORS TURN TO FOR DIVERSIFICATION? NOT ALL ALTERNATIVES ARE CREATED EQUAL

Many investors seek diversification through alternative strategies. However, not all alternatives provide the desired portfolio

diversification benefits. Diversification benefits vary significantly across styles, and many strategies have positive correlation during equity down markets.

Correlation of Alternatives to Equities

Based on Monthly Data from January 1990 through March 2022*

Q1 2022 CASE STUDY

In Q1 2022, markets experienced a trifecta of a selloff in equity and bond markets, heightened market volatility, and elevated inflation, making it a difficult start to the year for many investors. From an asset allocation perspective, investors should consider allocations to alternative strategies that, ideally, have positive long-term return potential and diversifying characteristics during difficult equity environments. Importantly, diversification should be a constant rather than a reaction to short-term market conditions.

*Alternative strategies above are represented by their respective HFRI indices. Data is presented from inception in January 1990 with the exception of the Credit and Trend Following indices, which are available from January 2008. For purposes of this presentation, we show broad hedge fund indices as categorized by HFRI, but our selection is not meant to be an exhaustive representation of all potential alternatives. Other investment strategies, including private equity, real estate, and venture capital, among others, are often considered to be diversifiers to traditional stock and bond portfolios but are not shown here due to limitations on the availability of a representative index or other constraints or considerations.

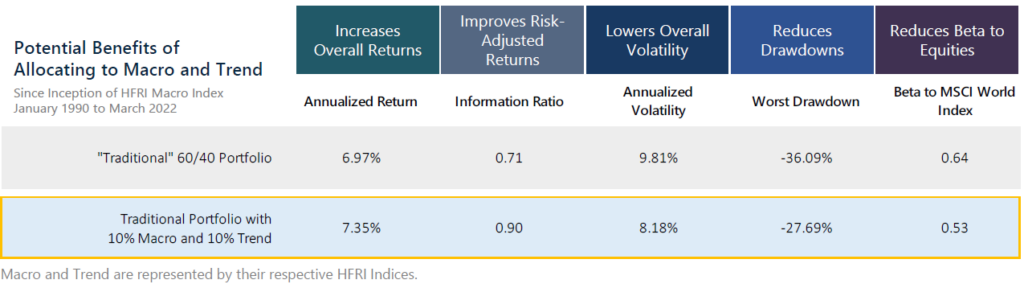

LONG-TERM BENEFITS

Market conditions continually change, and the best way to construct a portfolio resilient to changing market regimes is through proper diversification. Allocating to strategies that have low correlation to equities and bonds can be a valuable portfolio construction tool with the potential to lower the volatility and soften the drawdowns of an overall portfolio while adding to returns over the long run. These strategies are meant to complement – rather than compete with – traditional investments. And while it is unreasonable to expect any strategy to perform well at every discrete point in time, holding the diversifying alternatives as a long-term, strategic allocation in a diversified investment portfolio offers the potential for significant benefits.

Below, we show the impact of allocating to macro and trend-following strategies, which are widely regarded as effective diversifiers within an investment portfolio.

THE BOTTOM LINE

- In the current investment landscape, there is a need for alternatives that can offer both positive returns and diversification to both equities and bonds.

- Diversifying strategies such as macro and trend following offer significant long-term return and diversification benefits, with the flexibility to capture moves across a variety of market environments.

- Allocating to diversifying strategies as a strategic, long-term investment within a diversified portfolio can potentially enhance risk-adjusted returns and reduce overall volatility and drawdowns.

IMPORTANT DISCLOSURE

LEGAL DISCLAIMER

Source of data: Graham Capital Management (“Graham”), unless otherwise stated

This document is neither an offer to sell nor a solicitation of any offer to buy shares in any fund managed by Graham and should not be relied on in making any investment decision. Any offering is made only pursuant to the relevant prospectus, together with the current financial statements of the relevant fund and the relevant subscription documents all of which must be read in their entirety. No offer to purchase shares will be made or accepted prior to receipt by the offeree of these documents and the completion of all appropriate documentation. The shares have not and will not be registered for sale, and there will be no public offering of the shares. No offer to sell (or solicitation of an offer to buy) will be made in any jurisdiction in which such offer or solicitation would be unlawful. No representation is given that any statements made in this document are correct or that objectives will be achieved. This document may contain opinions of Graham and such opinions are subject to change without notice. Information provided about positions, if any, and attributable performance is intended to provide a balanced commentary, with examples of both profitable and loss-making positions, however this cannot be guaranteed.

It should not be assumed that investments that are described herein will be profitable. Nothing described herein is intended to imply that an investment in the fund is safe, conservative, risk free or risk averse. An investment in funds managed by Graham entails substantial risks and a prospective investor should carefully consider the summary of risk factors included in the Private Offering Memorandum entitled “Risk Factors” in determining whether an investment in the Fund is suitable. This investment does not consider the specific investment objective, financial situation or particular needs of any investor and an investment in the funds managed by Graham is not suitable for all investors. Prospective investors should not rely upon this document for tax, accounting or legal advice. Prospective investors should consult their own tax, legal accounting or other advisors about the issues discussed herein. Investors are also reminded that past performance should not be seen as an indication of future performance and that they might not get back the amount that they originally invested. The price of shares of the funds managed by Graham can go down as well as up and be affected by changes in rates of exchange. No recommendation is made positive or otherwise regarding individual securities mentioned herein.

This presentation includes statements that may constitute forward-looking statements. These statements may be identified by words such as “expects,” “looks forward to,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” estimates,” “will,” “project” or words of similar meaning. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of GCM’s management, and are, therefore, subject to certain risks and uncertainties. A variety of factors, many of which are beyond GCM’s control, affect the operations, performance, business strategy and results of the accounts that it manages and could cause the actual results, performance or achievements of such accounts to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements or anticipated on the basis of historical trends.

Tables, charts and commentary contained in this document have been prepared on a best efforts basis by Graham using sources it believes to be reliable although it does not guarantee the accuracy of the information on account of possible errors or omissions in the constituent data or calculations. No part of this document may be divulged to any other person, distributed, resold and/or reproduced without the prior written permission of Graham.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

DISCLOSURES AT THE END OF THIS DOCUMENT ARE AN INTEGRAL PART OF THIS DOCUMENT.