Volatility Premiums Are Currently at the All-Time Highs

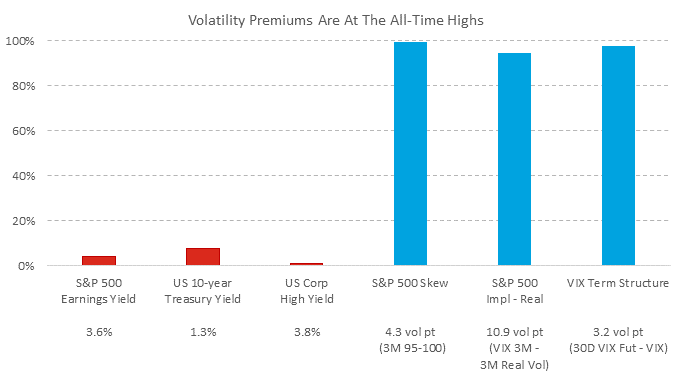

In the chart below we show the 15-year percentile of various premiums across several asset classes (as of August 2021). Earnings, bond and credit yields are at their 15-year lows. Equity volatility premiums (IV-RV, Term Structure, Skew), on the other hand, are in the 90th percentile. This may be the right time to take a closer look at the equity volatility premiums and their added value in a balanced portfolio.

volatility premiums are currently at the all-time highs